This chapter contains the following topics:

Producing Standard or Custom Reports

Using Customized Quarterly Report Formats

Use this selection to print the standard quarterly payroll reports supplied with the Payroll system or optionally to print your own customized quarterly payroll reports.

Payroll is supplied with two customized payroll reports. The formats for these reports can be viewed and printed using Quarterly report formats.

The standard quarterly payroll reports allow you to print a list of federal, state, and city taxes and unemployment insurance liabilities for any given quarter. There is also an option to print the SUI Expanded report.

See a Quarterly Payroll - Standard, standard example in the Form and Report Examples appendix.

Select

Quarterly payroll from the Reports, General menu.

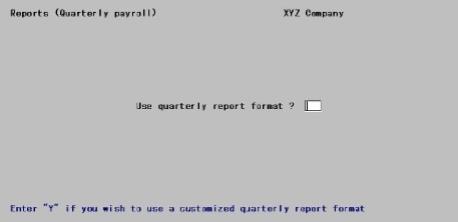

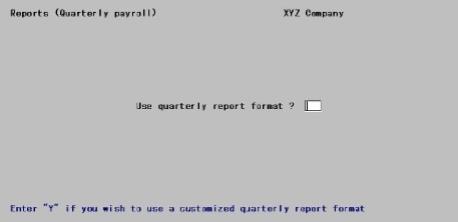

Answer Y to print a report using one of your custom quarterly report formats. Answer N to print the standard quarterly payroll report.

|

Format |

One letter, either Y or N |

|

Example |

Type N |

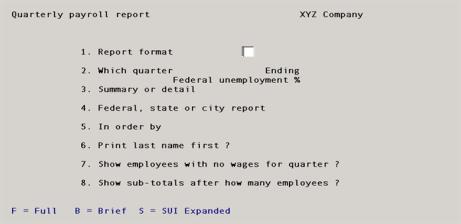

If you answered N, the following screen displays:

Enter the following information:

Type F for a full format, B for a brief format or S for SUI expanded format.

|

Format |

One character |

|

Example |

Type F |

The SUI expanded report is similar to the brief report except the Gross wages column becomes SUI wages, total SUI wages and wages over SUI max are added to the state SUI contribution section. The SUI totals are for the quarter, not the year-to-date totals.

However, if you are reporting the second through fourth quarter, the Wages over SUI Max total field is determined by adding up all quarters and then subtracting the previous quarters to get the total for the quarter being reported.

2. Which quarter ?

Enter the quarter for which the report is being printed.

|

Format |

One number from 1 through 4 |

|

Example |

Type 1 |

Ending

Enter the ending date corresponding to the quarter. The month and day portion of the date must be 3/31, 6/30, 9/30, or 12/31 for quarters 1 through 4 respectively. The year must be consistent with the Current payroll year field in Payroll Control information.

|

Format |

MMDDYY |

|

Example |

Type 33105 |

Federal unemployment %

This field allows you to enter the federal unemployment percentage, thus affecting only the running of the report and eliminating the need to update of the Federal tax table Federal unemployment % field in order to calculate the correct percentage on the report. The percentage from the Federal tax table Federal unemployment % field is provided as a default.

|

Format |

99.99 |

|

Example |

Press <Enter> for the default from Federal Tax Table |

|

Note |

Starting in July 1, 2011, the federal unemployment (FUTA) percentage changed. See IRS Publication 15 for 2011: http://www.irs.gov/pub/irs-pdf/p15.pdf |

3. Summary or detail

Options

If you selected Brief or SUI Expanded format in Field #1 Report format, this field displays as Not applicable and cannot be entered. Otherwise, your choices are:

|

S |

Summary format. Only the totals for each state and the federal totals are printed. |

|

D |

Detail format. Totals for each employee are printed in addition to the state and federal totals. |

|

Format |

One letter, either S or D |

|

Example |

Type D |

4. Federal, state or city report

Options

If you selected Brief or SUI Expanded format in Field #1, or summary format in Field #3, this field displays as Not applicable and cannot be entered. Otherwise, select which taxes you wish to appear on the report:

|

F |

For federal information |

|

S |

For state information. You will be asked which state. In the case of multi-state employees, information for the selected state will be included regardless of whether that is the primary state or an alternate state for any particular employee. |

|

C |

For city information. You will not be asked to specify what city; the report can be printed only for all cities. In the case of multi-city employees, information for a city will be included regardless of whether that is the primary city or an alternate city for any particular employee. |

|

Format |

One letter from the list above |

|

Example |

Type S |

Which state

This field displays only if you entered S in the preceding.

Enter the state whose information is to print. There must be one (or more) state entries in Tax tables whose tax code begins with this state abbreviation.

|

Format |

Two characters. |

|

Example |

Type CA |

5. In order by

Options

If you selected Brief or SUI Expanded format in Field #1, or summary format in Field #3, this field displays as Not applicable and cannot be entered. Otherwise, choose between:

|

S |

To print the employees in social security number order |

|

N |

To print the employees in employee name order. If these have been entered (in Employees) with the personal name preceding the surname, the report will not be in surname order. |

|

Format |

One letter from the list above |

|

Example |

Type N |

6. Print last name first ?

If you selected Brief or SUI Expanded format in Field #1, or summary format in Field #3, this field displays as Not applicable and cannot be entered.

If you have entered your employees in surname first order in Employees, you can choose to print the name in the normal sequence (personal name and then surname) by answering N to this question. This controls only the print format, not the sequence of the report. The position of the comma determines the surname; thus, multi-word surnames (like “van Horn” or “de la Mare”) are accommodated.

If your employees are already in personal name first, surname last sequence, Field #6 cannot be used to reverse the sequence (because there is no way of knowing which is the surname).

|

Format |

One letter, either Y or N |

|

Example |

Type N |

7. Show employees with no wages for quarter ?

If you selected summary format in Field #3, this field displays as Not applicable and cannot be entered. Otherwise, if you have employees you have paid during the year, but with no wages for the quarter you are printing, you can choose whether or not to include them on the report.

|

Format |

One letter, either Y or N. The default is N. |

|

Example |

Press <Enter> |

8. Show subtotals after how many employees ?

If you selected Brief or SUI Expanded format in Field #1, or summary format in Field #3, this field displays as Not applicable and cannot be entered.

Otherwise, enter how many employees you want printed before the report prints subtotals. Zero is interpreted as no subtotals.

|

Format |

99 |

|

Example |

Press <Enter> |

Field number to change ?

Make any needed changes. Press <Enter> to print the report.

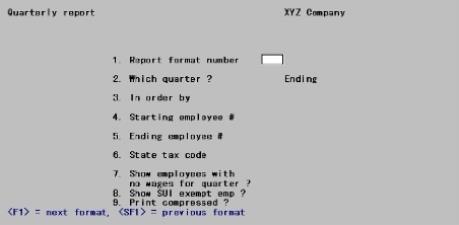

If you answer Y to use a customized quarterly report format, the following screen displays:

Enter the following information:

1. Report format number

Options

Enter the report format number to use for this report. This must previously have been entered and verified in Quarterly report formats. You can also use one of the options:

|

<F1> |

For the next report format |

|

<SF1> |

For the previous report format |

|

Format |

99 |

|

Example |

(No example is given because customized formats will not be entered until a later chapter in this documentation) |

2. Which quarter ?

Enter the quarter for which the report is being printed.

|

Format |

One number from 1 through 4 |

|

Example |

(No example is given) |

Ending

Enter the ending date corresponding to the quarter. The month and day portion of the date must be 3/31, 6/30, 9/30, or 12/31 for quarters 1 through 4 respectively. The year must be consistent with the Current payroll year field in Control information.

|

Format |

MMDDYY |

|

Example |

(No example is given) |

3. In order by

Options

Your answer determines the order in which employee items are printed in the Employee area of the report. Your choices are:

|

S |

To print the employees in social security number order |

|

N |

To print the employees in employee name order. If these have been entered (in Employees) with the personal name preceding the surname, the report will not be in surname order. |

|

E |

To print the employees in employee number order |

|

Format |

One letter from the list above |

|

Example |

(No example is given) |

4. Starting employee # and

5. Ending employee #

Options

Enter the range of employees to print in the Employee area of the report, or use the option:

|

<F2> |

For the First (in Field #4) or Last (in Field #5) employee number |

|

Format |

999999 |

|

Example |

(No example is given |

6. State tax code

Enter the state whose information is to print. There must be one (or more) state entries in Tax tables whose tax code begins with this state abbreviation.

The employee wage figures printed on the quarterly report are obtained from your Quarter to Date History. The report will print the Quarter to Date wage information only for the state whose tax code you enter here.

|

Format |

Two characters |

|

Example |

(No example is given) |

7. Show employees with no wages for quarter ?

Answer Y if you want to include employees who earned no wages during this quarter (hired after the quarter ended, terminated before it began, or on unpaid leave).

A Y answer means that such employees are included in addition to (not instead of) the employees who did earn wages.

|

Format |

One letter, either Y or N. The default is N. |

|

Example |

(No example is given) |

8. Show SUI exempt emp ?

Answer Y if you want to print items for employees exempt from state unemployment insurance payments.

A Y answer means that such employees are included in addition to (not instead of) the employees who are not exempt.

|

Format |

One letter, either Y or N. The default is N. |

|

Example |

(No example is given) |

9. Print compressed ?

Answer Y if you want to print a compressed font (approximately 17 characters per inch, allowing 132 print columns to appear on 8¾” paper).

|

Format |

One letter, either Y or N. The default is N. |

|

Example |

(No example is given) |

Field number to change ?

Make any needed changes. Press <Enter> to print the customized report.

If this report format is for pre-printed forms you are asked to mount the forms in your printer, given an opportunity to print a sample form to check alignment, and told to mount regular paper after printing is completed.

If you are using a laser printer, you can print multiple copies and can adjust the alignment of the printer on the screen. For details, refer to the Starting PBS, Menus and Printing chapter of the PBS System documentation.

The custom quarterly payroll report then prints. If you are using a laser printer and this report format is for pre-printed forms, you are asked to enter the number of copies and the labels for each copy before printing.)

After printing begins, you can press <F1> at any time to stop the printer.